If you are preparing for big plans in the future, whether buying a new home or even having a child, you will need to save a lot of money fast, and these some simple tips can help you achieve your financial goals if you are not sure where to start, here are 5 best way to save a lot of money fast

According to research, nearly 60% of adults do not have enough money saved to cover a $1,000 emergency and nearly a third of those people would have to resort to borrowing money to pay for any unexpected expense which as we all know adds up to a lot more money in the long run when you account for interest on top of that and it’s with this information that it’s no surprise that Americans are just not saving enough money even when we go back and look at things historically the average

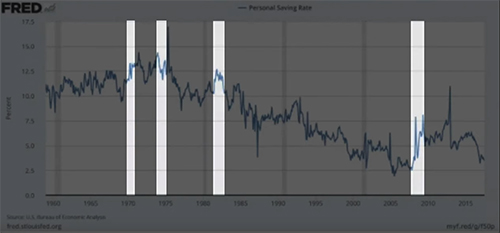

American savings rate peaked in the 70s with the savings rate of about 12% and then since then it’s been very slow and steady

Americans are pretty much-saving nothing now what’s even more disheartening is that during recessions savings immediately spikes upwards as shown on the gray lines in this graph

then as soon as the economy starts doing better the savings rate starts trending

back downwards

This tells me that people can and do cut back if needed but as soon as things start looking optimistic they go back to their normal spending and start saving less

Now we can certainly look at external economic factors and the lack of wage growth to be the culprit for this but I believe that at the end of the day it’s really up to us to take personal responsibility to not only learn on how to save money but also do the best that we can give the income that we have and when it comes to saving money these are the five tricks that I found that work

Exceptionally well to save a lot more money without ever feeling like you’re cutting back even though you are and each of these money-saving tips can be implemented immediately as long as you

just follow these techniques

The first tip on how to save money fast is:

don’t spend any money

just kidding obviously okay no but for real though the first trick that

I use is that if there’s anything I’m looking to buy I never buy it now and

instead, I buy it tomorrow

Now this one is just about cutting down on the impulse purchases that you make without ever really realizing it and this one is especially interesting once you start digging deeper and this is because many studies have shown that shopping releases dopamine in the brain that brings about a sensation of happiness and well-being and if we go even deeper down the rabbit

hole, because this is what I was doing all last night, is researching the

effects of shopping on the brain don’t ask me why I found this stuff

interesting but here we go

this is the best part about all of this is that they found the real dopamine hit doesn’t come from actually buying the item that

you’re going out to get instead it comes from the anticipation of buying the item itself from this we could conclude that buying something won’t necessarily give you that fun excitement that you’re looking for and you can get all of the same enjoyment from shopping if you just don’t actually buy anything and if you just window shop instead and that happens to save a lot of money fast this is pretty much the strategy that I’ve utilized all the time

If there’s something I see that I want to get all I do is basically just don’t buy it right then in there instead I’ll just sleep on it and wait to buy it the next day by then if I still want it most of the time I’ll get it but I would say more times than not the desire to buy that thing just subsides and I no longer want it the next day

I’m positive if you just implement the same thing you can cut back and save a lot of money fast without ever feeling like you’re cutting back or saving money just by waiting 24 hours

The second

Would You Rather Have The Cash?

assuming you’ve waited a day and you’re thinking about buying something then think to yourself if someone offered me the cash equivalent for this item right now what I rather just have the cash

Sometimes we forget about how much something costs when we’re so fixated on just buying the thing that we want but start thinking to yourself if you have the choice between buying this item or getting paid that exact amount of money which one would you choose?

If you decide not to buy something and save the difference it’s almost as though you just got paid to save now I know this is a bit of a flawed way of thinking because I could just say to myself

“you know what I was just about to buy two million dollars Bugatti but I decided not to do it so I just saved two million dollars by not buying into Gotti”

That would be by the way an amazing clickbait title

Can you just imagine it how I save two million dollars by not buying a Bugatti, but anyway when you apply this mentality to everyday purchases you don’t spend much time thinking about it gets you prioritizing what’s important and what’s gonna give you the most long-term value

And helps make you think more about the aspect of money saving tips than the aspect of buying the thing that you want now this becomes especially evident when you look around at all of the things that you’ve bought how much of that do you wish you could trade back with the snap of your fingers and get back what you spent on it and I have a feeling that probably half of my wardrobe would be gone from things that I bought that I just never really wore and they just were not worth it

Especially when you divide how many times you’ve used something versus how much it costs like the hundred dollar pair of shoes you wore twice that means it costs you $50 every time you’ve worn those shoes or that $300 Bose speaker that you’ve used like five times in the last year that means it was $60 every time you’ve used it

So begin thinking of everything in terms of how much it costs you peruse and also whether or not you would have taken the cash equivalent if you had the choice and I guarantee that by doing this

you’ll end up spending a lot less and by that you’ll end up saving a lot of money fast

The third

your money or your life

To save a lot of money fast money is to think to yourself how many hours will I have to work to pay for it so if you’re making twenty dollars an hour and you decide to drop sixty dollars on dinner in a way that dinner is costing you three hours of your time to pay for it

We’re going and spending twenty dollars on your lunch break is the equivalent of you working an extra hour just to pay for it this is

pretty much the entire premise of the book

your money or your life

which by the way if you have not read this book I highly recommend reading it

I have this going to summarize the entire book, basically we all have a very limited amount of time on this planet and it’s really up to us to make the best use of that time not only from a financial standpoint but also from personal fulfillment

Given that it’s vital that we spend our money on the things that are most important to us and since our time is such a limited resource we shouldn’t waste our time working for things that don’t bring us long-term value and sometimes when you consider how long you’re gonna have to work to pay for something that you might not use it makes you

reconsider whether or not that thing is worth buying in the first place it

I think the same way when I’m working out and going to the gym as I think to myself what I’d rather eat a Snickers bar and then spend 40 minutes on the treadmill to burn it off or what I’d rather just not eat the Snickers bar and I think we all know the answer to that is is that I would rather spend 40 minutes on the treadmill to burn off the Snickers bar the answer is :

I don’t eat the stickers bar

it’s a lot easier to cut things out than it is to burn them off and the same thing also applies to spending like it’s a lot easier not to buy something than it is to make more money to pay for it and again when you start thinking this way

I guarantee you that you’ll become more mindful about where you spend your money and just understanding how long that’s going to take you to pay for it

Fourth

Save Your Savings

A fun exercise that you can do at any time you spend less money or save something is by immediately transferring that to another account now this is a great way to not only make sure that you save that money but it’s also really effective because you could begin seeing the immediate results of saving as soon as you save by having more money in the bank account like for instance instead of going out and spending $20 at lunch you cooked at home and that only cost you $10

Now since you went ahead and saved that $10 go ahead and transfer $10 from that account to another account that you’re gonna be saving up money in then apply that to every single one of your other expenses

where you can cut back and save money and when you start doing this you’ll just watch the savings add up over time again this is just about seeing an immediate reward for slowly cutting back overtime and beginning to see your results in real-time

I think once you begin seeing it work firsthand you’re gonna be excited about the aspect of just having extra money laying around and you’ll be more likely to stick with it and

Fifth

Think about Future Value

Most importantly think of what your money is going to be worth in its future value like when you save your money and invest it, it’s going to grow over time and when you go and spend it it’s really like you’re halting the growth of what that money would have been worth had you saved and invested it

Instead so if instead of buying avocado toast you just took that $20 and

invested it over the next forty years and we took the average historic return of the stock market adjusted for inflation with dividends reinvested it’s a lot to say that $20 will have turned into nearly three hundred dollars of future money

So I just think to myself okay is this avocado toast worth three hundred dollars in the future and if the answer is no then I just don’t

buy it now I’m a nut case and I think of everything this like a $5 cup of coffee at Starbucks to me is like well is that worth $75 a future money and the answer is no because I can make coffee myself for about 20 cents a cup and you pouring the coffee make coconut creamer and it’s and it’s delicious and it tastes way better than Starbucks for a fraction of the price

So start thinking about how to save lot of money fastn and also about your purchases in the same way as well and ask yourself if what you’re buying is going to add the equivalent amount of value now then you would have in the future had you just saved and invest in it and if the answer is no that don’t buy it and if you do decide it’s gonna be worth it then, by all means, go for it

There’s always a fine line between living in the moment and enjoying life and saving for the future and that line for all of us is going to be different so just make sure you stay true to yourself and you understand what you’re giving up in the future if you decide to get something right now this is why it’s so important to find a happy medium that works best with you so that you don’t feel like you’re missing out but at the same time you’re prepared for the future and save money

Lastly, one more thing I want to mention because this part is vital to anyone who wants to increase their savings and thinking for the best way to save a lot of money fast, the harsh reality is that if you’ve already done all of the above and you’re still not saving enough money there’s no way around it you need to make more money that is the truth

And when I say something like this I don’t mean for it to sound like the

person who says

“Oh a homeless person should just buy a house and then they wouldn’t be homeless anymore”

because they get how it sounds just make more money and then you can save more as if you’re not already trying to make more money but when it comes to doing this at a certain point there’s only so much that you could save

You can only cut back so much until you’re a minimalist living in a van doing intermittent fasting and picking up pennies off the ground everyone will get to a point eventually where you cannot possibly save any more money and it’s at that point that you should begin to shift your efforts from instead of saving more money learning how to increase your income this could be learning a new skill picking up a side job looking into switching careers or smashing the like button you name it the

point is increasing your income is the necessary last step when it comes to saving more money

and just like you can get to the point where you cannot possibly save any more you can also get to the point where you cannot possibly work any more hours in the day

It’s for that reason that I like any available results paid business this could be sales affiliate marketing or any sort of online business any business that pays you out based on your results and not how many hours you work

I took these tricks from Graham Stephan, so thanks to him for this tip on how to save money a lot of money, I tried them and worked well for me, so I shared it with you

And I believe that it’s by implementing these strategies slowly over time and then sticking with it that’ll give you the potential to end up saving a lot of money fast without really even realizing it until you take a look at your bank account and you see a whole bunch of extra Benjamins that are there now that weren’t there before